Top 5 UK Challenger Banks in 2023

What is a Challenger Bank?

A challenger bank is basically a smaller, recently established bank that aims to challenge the dominance of the traditional banking giants in the UK. They compete with big banks such as Lloyds, RBS, Barclays and HSBC.

They are primarily online and app based banking setups.

Unlike traditional banks, Challenger Banks do not have physical branches where customers can go, they offer their services through smartphones and usually rely on and collaborate with other Fintech (Financial Technology) companies to offer vertical financial services that they don’t cover.

Challenger Banks are similar in some ways to Neo Banks, but there are differences. We’ve prepared this user guide of you’d like to learn more about the differences between Neo Banks and Challenger Banks.

However, some Challenger Banks are now coming up with new ways of establishing their physical presence across the UK. UK Challenger Banks are starting to put down roots. Starling, for example, now allows you to deposit cash into your digital account at Post Office branches.

Customers, especially younger generations, usually prefer using them because they are easy to access remotely and tend to offer the better savings rates, exchange and international transaction fees.

To bridge the gap with their users, Challenger Banks often use unconventional marketing and communication methods – preferring videos and social networks to emails and phone calls.

Some of the most famous examples are N26 (born in Germany), Monzo (born in the United Kingdom, and operates only in the UK), Monese and Revolut.

UK Challenger Banks – The Benefits Which Challenger Banks Offer

1. Although they offer services very similar to those of traditional banking, their offer of products is still limited. The commissions that challenger banks collect are relatively smaller than those we are used to paying in our usual banking operations. So making international transfers and withdrawing cash from an ATM is supposedly much cheaper. In addition, by making clever use of the latest mobile technologies, users can perform banking operations on their mobile device at any time or place and faster than was previously possible.

2. Cyber security, as for all banks and financial service operators, is obviously held in high regard. The challenger banks use advanced security measures such as biometric recognition systems, facial recognition or fingerprints to improve the security and privacy of their products.

3. Affordable and highly transparent fees and charges.

4. The challenger banks allow you to invest in new and upcoming economic products such as Cryptocurrencies, and stock purchases through a mobile interface.

5. Lower infrastructure costs, means cheaper services for end customers. By nature of the fact that challenger banks supply their products through the internet and in a completely digital way, they benefit from reduced running costs. Often there are no commissions in their basic banking fees which are otherwise paid with traditional banks, such as the account administration fee or the maintenance costs of the cards associated with the account.

6. The challenger banks use the latest technologies allowing their users to take advantage of a user experience which is often superior to the online banking offerings of many traditional banking institutions.

7. The added value they offer to their users often translates into having greater control over personal expenses. Most challenger banks have in-built tools which make scientific use of data to forecast things like the customers average outgoings, or end of month balance.

8. Easy account opening process and fast processing of bank services and better response to customers’ needs. Challenger banks are the envy of traditional high street banks when it comes to speed and ease of opening up a new account.

UK Challenger Banks – Best UK Challengers Bank in 2023

UK Challenger Banks – Revolut

Revolut debuted in 2015 and has since attracted over 2 million members. Despite its huge reported losses to date (it was still yet to turn profit as recently as 2020), the bank is expected to continue to grow and be hugely successful.

Revolut boasts an elegant, streamlined app that helps in providing progressive banking. Revolut is, however, currently only available in Europe. The Revolut app and linked card are also the best for card control.

UK Challenger Banks – N26

N26 is a German based digital first challenger bank that has over the years found its way throughout Europe.

Hold on – you might be wondering why a German challenger bank is on a list of the top UK challenger banks… well thats simply because N26 operates in the UK and is available to UK residents.

Although the Challenger bank has found itself in the government’s cross-hairs for not implementing sound systems to curb money laundering, it is still leading the pack in revolutionising this sector.

UK Challenger Banks – Monese

Monese bank describes itself as the ultimate solution to the unhealthy bureaucracies that have been dogging the financial sector for ages. It seeks to provide a ‘true’ digital banking experience, away from the traditional branches and their rigid operations.

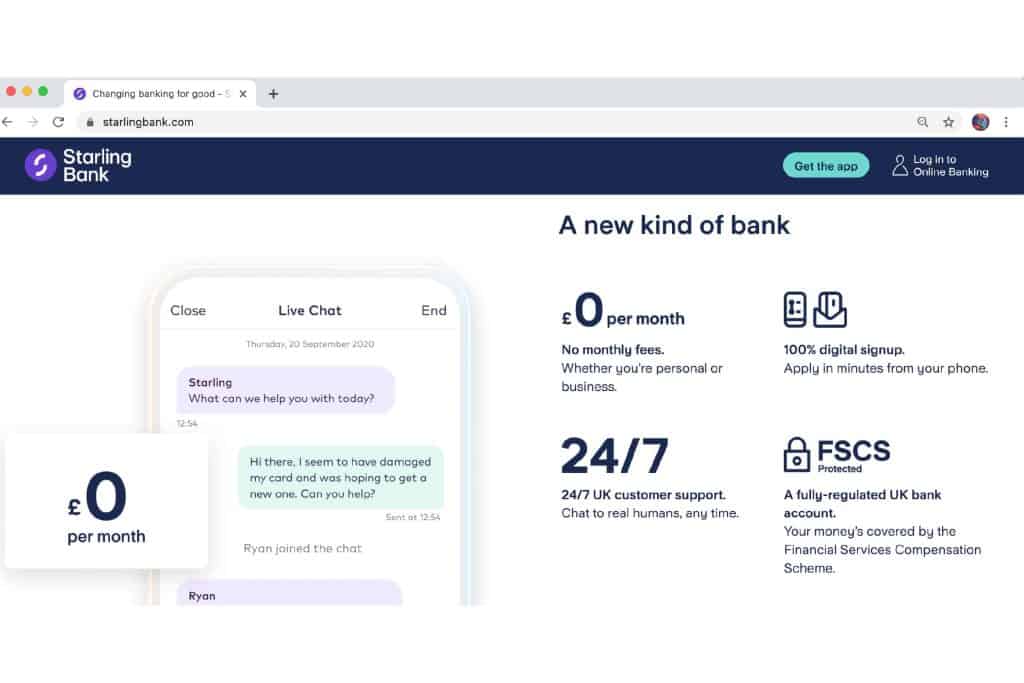

UK Challenger Banks – Starling Bank

Starling Bank can be best described as a digital piggy bank, and was specially designed for individuals looking to get in sync with their spending. It seeks to provide you with the best personal current account in the world, specially tuned to help you to manage your finances.

The Starling Bank app will regularly present you with an automated report detailing your expenses, along with tips on how you can maximise your savings.

UK Challenger Banks – Monzo

If you are looking to manage your cash by understanding how you spend your balances to the last coin, the Monzo Bank app and their contactless Hot Coral debit card are a great option. The Monzo banking app is also widely regarded as the best for tracking expenses.