Differences between a NEO Bank, a Challenger Bank, and a Traditional Bank

Digitalization & Fintech

When you hear of digitalization, what comes to mind? Probably the digitalization of services like education or the advancement of technology.

It is quite clear that everything in the world is going the digital way. And where that’s concerned – the banking ecosystem has certainly not been left behind.

If you have been keen on following the fintech trends, I am sure you have seen the recent rise of digital banks, such as challenger banks and neo banks. And if you haven’t heard any of these mentioned, then you should know that these are now the trending and fastest growing banks in most parts of the world.

So, with the rise of neo and challenger banks, what is now the place of traditional banks? And is there a difference between traditional banks, neo banks, and challenger banks? Well, that is why you have this article. This post is well detailed on the differences between these three types of modern bank.

To understand these differences, we are going to look at each bank in turn.

Banking is an industry that offers transactions such as handling credit, cash, etc. through banks. Banking is one of the essential services across the globe.

You could go as far as to call banking a basic necessity for almost every human being. Yet still a large portion of the world’s population remain “un-banked”, which is something a lot of the new players to the banking sector are trying to rectify.

What are traditional banks?

Traditional Banks are banks with physical locations which are fully licensed to operate in a given region and provide financial services to consumers in that ares.

These banks have headquarters and other branches located in various places across countries. Many of these traditional banks have ATMs branded the bank’s name.

Unlike the olden days, where you would find these banks only in the big cities, over the years, various banks have opened many branches even in remote towns. All in an effort to bring their banking services closer to the people.

Many benefits come with using traditional banking.

Some of these benefits include:

- It offers more options. This means that you can access almost every service you require, from cash deposit to trust fund, checking balances, making personal savings, through to investments.

- They are very convenient as most banks have their branches in almost all locations. The convenience is also for all people, whether you want to visit the branch or you want to do your transactions online since they also offer optional online services. And for people who often deal with cash, it is very convenient for them.

Nevertheless, traditional banking is becoming a bit old-school and out-dated. The rest of the world is moving with a trend towards technology adoption and digitalization. And with the introduction of online banking, neo and challenger banks are making great use of this opportunity and now gaining more popularity.

What is a Neo Bank?

A Neo Bank is a type of digital bank that does not have physical locations or high street branches. Instead, it is fully online.

These banks are fintech (Financial Technology) firms offering mobile-first banking services, including digital money transfers, payments, investing, and money lending, among many other services.

Mainly, neo banks do not have their own licenses to operate. Instead, they partner with other banks already licensed.

So, how exactly does neo banks operate?

They are similar to traditional banks in that they enhance the inflow of money and lending to customers. Since there are no physical locations, customers use online platforms and apps to access their services. And as you would expect, customer fees are lower compared to traditional banks.

They are also able to collect and analyze data on how their customers view their services through modernized platforms. They are then able to act and create cohorts from the customer’s reviews.

Challenger Banks

Challenger banks are also a variety of digital bank, and have their own private banking license. With this license, they provide similar services as those offered in traditional banks. However, they offer these services at a more flexible scale.

With them being digital first, yes – a lot of Challenger Banks also offer services to buy and sell Bitcoin and other Cryptocurrencies.

Although they share a similarity with traditional banks, they differ when it comes to online services. Challenger banks can have distinct banks with physical locations, but there are also have others that are digital-first and online only.

So, basically what challenger banks do is provide certain services traditional banks do not offer to people. There are more than 100 challenger banks across the globe.

Why are challenger banks and neo banks experiencing such rapid growth?

There are a few factors, including:

- A 24/7 support and a user-friendly interface

- Have very friendly government regulations

- Very convenient to customers due to the quick process of account opening

Differences between a Challenger Bank and a Neo Bank

Many people think that neo banks are similar to challenger banks, mainly because they are both digital banks.

Yes, they share some similarities, but they are quite different in a few key ways:

- Neo banks partner with other banks to offer their services because they do not have their own license. On the other hand, challenger banks are fully licensed.

- Unlike neo banks which often focus primarily on certain customer segments such as SMEs, challenger banks handle a complete scope of banking operations.

- Neo banks are entirely online and do not have any physical locations, but a few of challenger banks do actually have physical locations.

The Best Neo Banks and Challenger Banks

There are various challenger banks and neo banks, but there are some which have been pointed out as the main players, especially in the US and UK.

Below is a list of Top Ten Neo Banks & Challenger Banks:

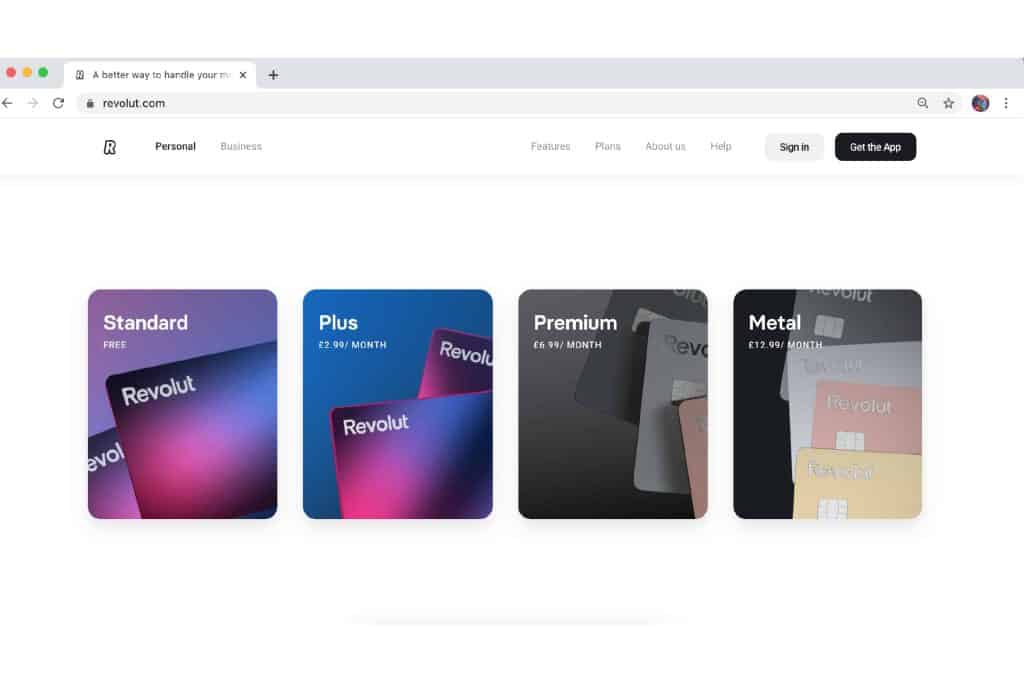

1. Revolut

This is a Neo Bank based in London and has grown to be among the hottest players in the online banking sector.

Revolut is available not only in Europe, but is also growing rapidly in the United States, Singapore, and Australia.

In the last four years, this bank has cumulated over 6,000,000 customers and raised about $344 million through private investments, and this growth does not appear to be slowing anytime soon.

Some of Revolut’s basic features include:

- Push notifications

- Round up spare change

- Scheduling of recurring payments

- Spending categories

With Revolut, you can send money in more than 150 currencies and can even spend money abroad whilst taking advantage of the normal interbank exchange rate. Revolut’s app also assimilates multiple cryptocurrencies and stock trading with no commission for premium customers.

Revolut – Pros

- Auto-saving features

- Stock trading with no commission

- Cryptocurrencies for premium customers

Revolut – Cons

- System interruptions for maintenance and updates

- Low ATM limit

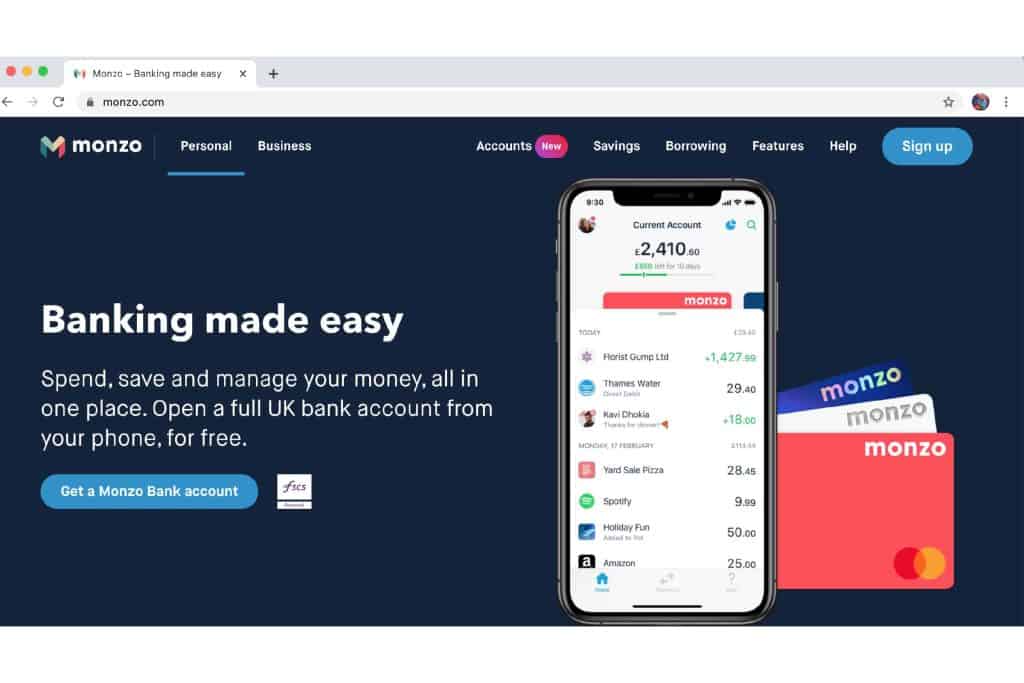

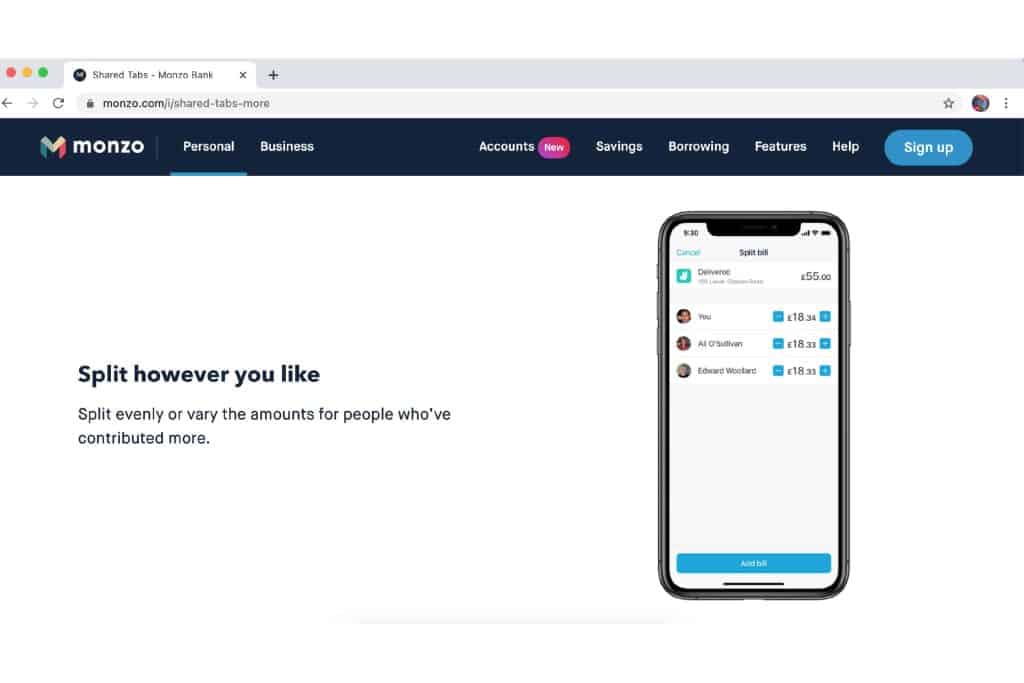

2. Monzo

This is a challenger bank guided by fairness and transparency. It was originally launched in the United Kingdom but has now expanded across and into the US market.

Monzo provide Plus, Basic, and Business accounts which allow you to get a contactless debit card with no fees for paying within the US. However, any withdrawals above £200 made overseas receive charges at a rate of 3%.

Monzo’s app has features that are designed to simplify and streamline your financial life including:

- Splitting bills

- In-app and pots support chat

- Direct transactions to other Monzo accounts

The bank is very flexible and has a very strong mobile banking app, making it one of the best banks in the United Kingdom. It also allows the opening of accounts by any person above the age of 16.

Monzo – Pros

- The interest of 1% on savings of over £1,000

- Regulated PRA and FCA

- Spending divided into sixteen various categories

Monzo – Cons

- It has a withdrawal limit of £400 per day

- Charges a fee of 3% on International ATM withdrawals above £200

3. N26

N26 is a mobile-only bank which was first launched in 2015 and had no physical locations. The bank is available in Europe and the United States. The N26 mobile app is well-positioned in Germany, Spain, the United Kingdom, and the Netherlands, among other countries.

N26 introduced their services in the United States in 2019.

The bank is a master of many partnerships. They offer various services through partners such as Raisin, TransferWise, Auxmoney, Vaamo, Clark, among others.

They also offer excellent customer support services available in Spanish, English, German, Italian, and French.

N26’s most famous feature is the ability to create multiple spaces and sub-accounts to allow you to organize your financial goals and better track spending and bills.

The bank has opted to offer a ‘freemium’ model instead of a sometimes-free account.

N26 – Pros

- Saving account and savings for Germany

- It provides P2P transfers via email or phone to the N26 account users

- N26 provides money transfers through TransferWise

N26 – Cons

- You have to cater for the monthly maintenance for a premium account

- Their services are limited outside Germany

4. Nubank

This is one of the fastest-growing challenger banks in Latin America.

First launched in 2014, the headquarters of Nubank are situated in Sao Paulo, Brazil. Since 2014, it has been serving its customers who have an appetite for financial simplicity.

This bank has more than nine million accounts and recently exceeded a valuation of $4 billion. Nubank counted a cash injection of $180 million from the Chinese tech giant Tencent in 2018, following previous investments of more than $420 million.

The bank has features such as:

- Credit card

- Rewards

- A debit card that is fully-integrated

- Loan offers

- Free account with no maintenance fees

Nubank – Pros

- There are available loans and credit card

- The accounts are free requiring no maintenance

Nubank – Cons

- The banking service is only available in Brazil

- Each cash withdrawal has a fixed fee.

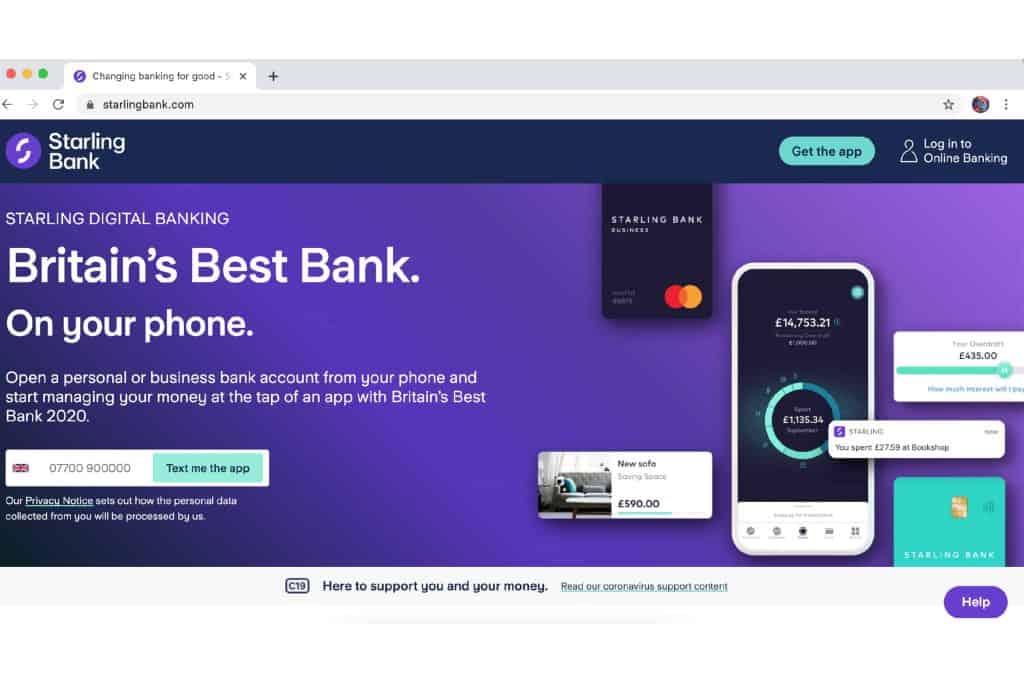

5. Starling Bank

The bank is available in the United Kingdom and offers a full account which you can open and manage through the app.

The main aim of the bank is to make banking more customer-focussed, and make it possible for you to access your finances wherever you are.

The bank uses modern technology to simplify how you manage your finances, and through this it has become one of the world’s fastest growing banks.

Some of the features included in the Starling Bank app are:

- Transfer of finances from your old bank

- It has a credit activation option, and you can also deactivate it in case it gets lost

- It gives you a record of all the transactions you have made.

The bank also offers a 0.25% AER for amounts under £85,000 and 0.5% for amounts below £2,000.

Once you open an account, you will be required to submit your ID photo and video. After which you can be assured of best-in-class security for your finances.

Stalring Bank – Pros

- It pays good interest on the account balance

- There are no fees for spendings abroad, including withdrawals from the ATM

- They are fully licensed by PRA and FCA

- The overdraft fees are easy to understand and competitive

Starling Bank – Cons

- There are no bank branches

- They do not offer most of the complex services

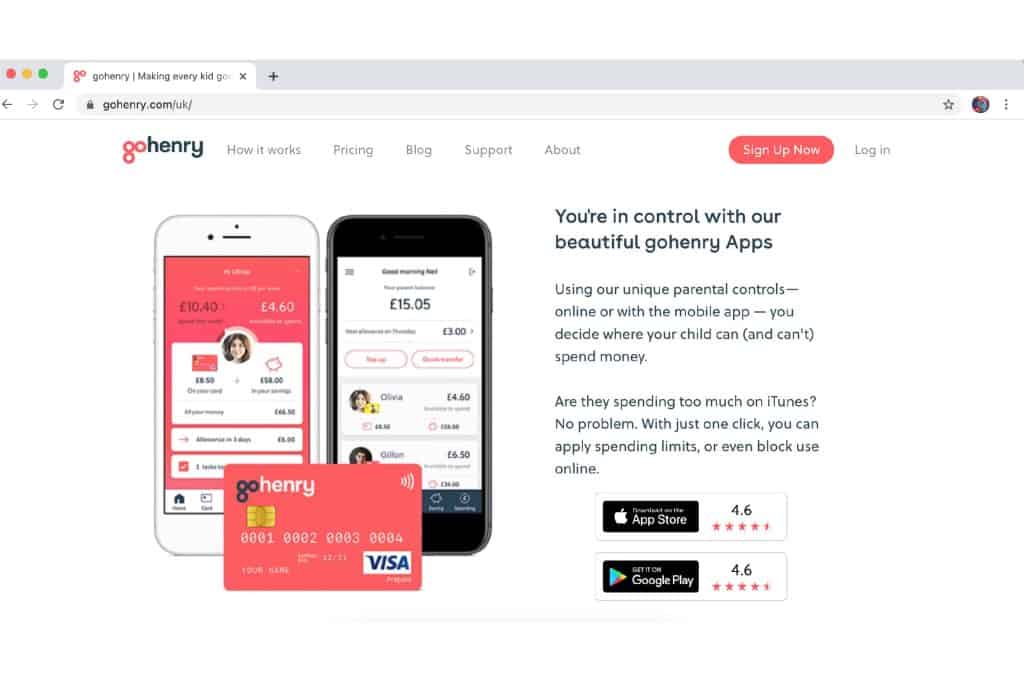

6. GoHenry

If you are looking for the easiest and the most convenient way to pay pocket money to your kids or train them on good money habits, GoHenry is the best bank for you.

GoHenry is an account for both parents as well as children, and caters to children ranging between six to eighteen years. It has a parent account where the parents can deposit money for their kids and a child account where the child can view the account balance as well as the spending limits established by the parent.

The bank also provides a Visa prepaid card that the child can use to make purchases in shops or withdraw money from ATMs.

Some of the key features in the GoHenry app are:

- Instant notifications. You receive notifications immediately your child uses the card.

- Options for rewards after completion of duties. You can set that money is only released to your child only after they complete their tasks.

- Automatic blocking of transactions from age-constrained exercises.

GoHenry – Pros

- The parent has full control

- It offers a one-month free trial

- One parent account can manage up to four child accounts

- Children as young as six years old can use it

GoHenry – Cons

- There are no interest rates

- You only get one free top-up to the child account in a month (paid options thereafter)

7. Revolut Junior

This is a digital bank for kids that offers you flexibility as well as low fees charges. It mainly targets those people who often travel by offering international money transfer and spending abroad.

Revolut was launched in 2015 and had more than 8 million customers. Opening an account is quite simple as you only need to get an app and register – there are no credit checks or proof of address required, which speeds up the sign-up process.

Revolut-Junior – Pros

- It has instant spending notifications

- Opening an account is very fast as it will only take about five minutes

- Offers 24 hours of customer service

Revolut-Junior – Cons

- There are limitations of free cash withdrawal to only £200

- No complex services available

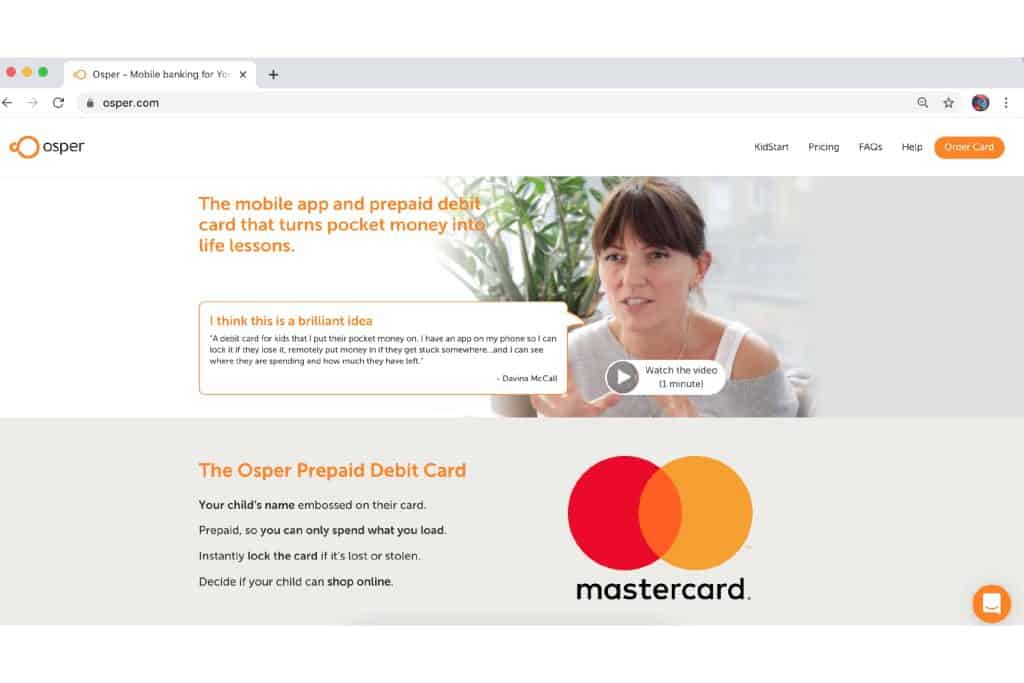

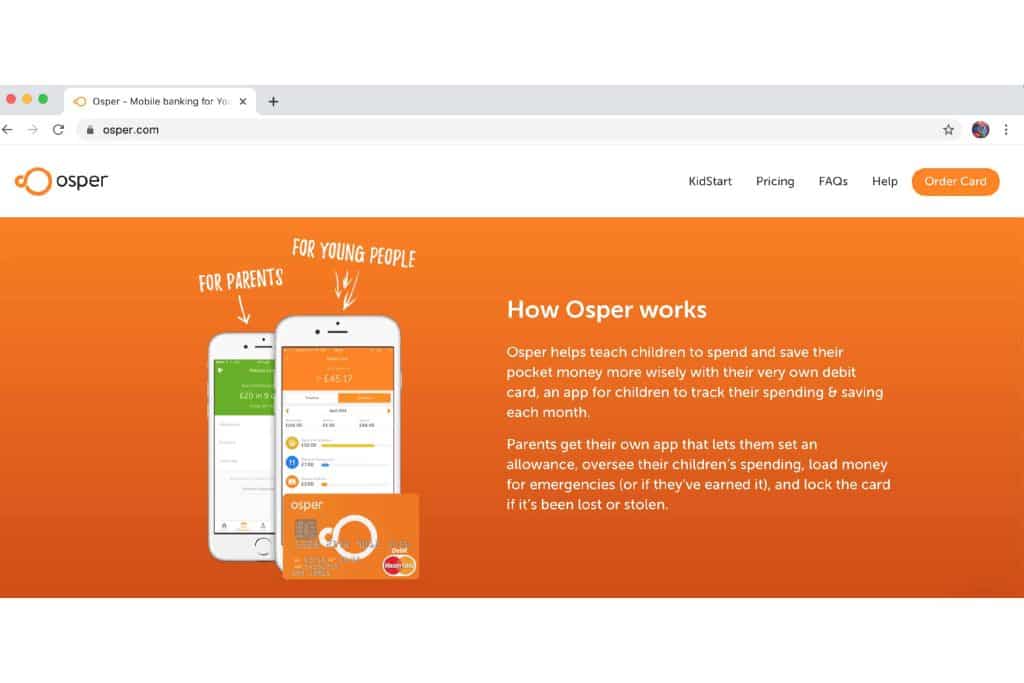

8. Osper

Osper is online banking product for people under eighteen years of age.

It has a parent’s account as well as a child’s account.

The parent has the full control of the account through the app. Osper provides a card which the child can use to make withdrawals from ATMs or make payments for goods either online or in shops. The app’s greatest feature is that the parent can monitor all the child’s expenditures.

Osper – Pros

- There are no overdrafts, and you cannot withdraw more than what is in the account

- The parent has the full control of the account

Osper – Cons

- Getting the account may cost you

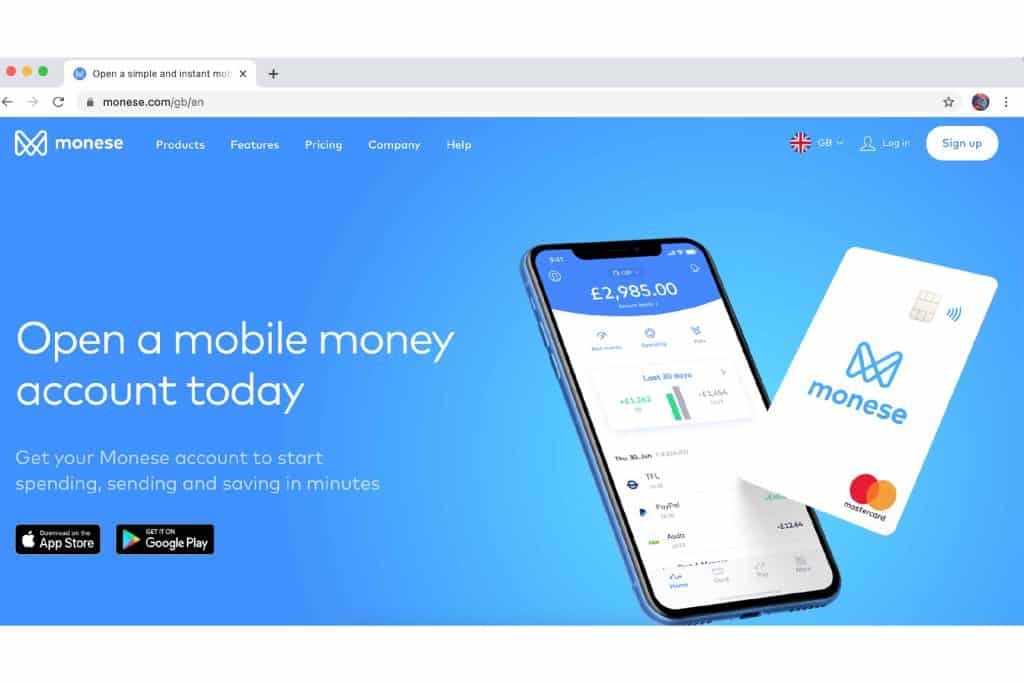

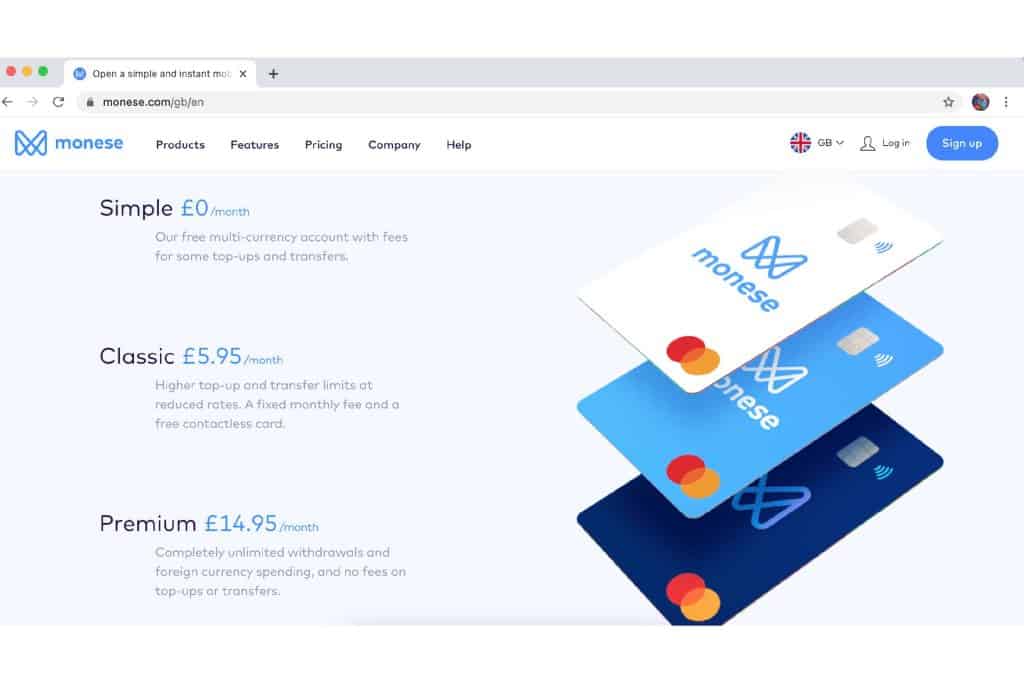

9. Monese

Monese has been in operation since 2015.

The bank has a feature that allows you to open an account anywhere in the UK and in the European Economic Area (EEA).

The Monese bank account is managed via a mobile app, and also offers you a debit card, which you can monitor through the app. Monese also provide excellent and friendly customer support services through email or instant messenger.

Monese – Pros

- It is very fast to open and easy to use

- Free ATM withdrawals and card payments abroad

Monese – Cons

- There are no physical branches

Neo Banks & Challenger Banks – Why you should consider using these digital banks

It is quite certain that challenger banks and neo banks are here to stay and aren’t about to fall out of fashion any time soon.

They are very effective and convenient, and for your own convenience, benefit and better banking – you should consider making a switch to them.

Or, if you do not want to divorce your traditional bank completely, open a secondary account with and of the banks mentioned above.

Here are some of the key reasons why you need to open an account with one of these banks:

1. Create an account with no hassle

The process of opening a new bank account with a traditional bank can be quite tedious and a general pain in the neck. Especially considering the big queues you can find in high street branches, and not forgetting the time you take to actually get to the bank.

However, with neo and challenger banks – creating and opening a new account is quite easy. All you need is to have your phone or computer, be ready to follow a handful of very simple steps, and before you realize it – your account is already open, active and ready for you to use!

2. Unified international payments

Ever suffered a humiliation where you went to make a payment with a debit card from your traditional bank only to be told it cannot work there?

That can be really frustrating.

Not all traditional bank debit cards can be used internationally. Or some can only be accepted in a few limited countries. Indeed, for you to make an international payment you might well have to first raise a request with your bank, which can take quite some time.

With an account with these digital banks, you do not have to worry about any payments (national or international).

You can make any transaction anytime from wherever you are in the world.

3. User-friendly interface

These banks offer you great customer experience, and you don’t have to worry about an unresponsive site. They operate with apps that are very clean, user-friendly, and crisp. Mobile-first banking apps are well-designed and responsive, and you can be sure they will meet all your needs.

As a result of this, they have become a hit amongst their customers, both young and older generations.

4. Smart reporting and actionable insights into your finances

Challenger and Neo Banks offer immediate transactions with details of your up-to-date account balance instantly populated.

You only need your app to access the account balance and transaction records. Most apps will also have a weekly or monthly saving goal, which you can customize to suit your needs best.

In this way, you can manage your finances better and in a more informed manner.

Differences between a NEO Bank, Challenger Bank, and a Traditional Bank – Conclusion and Wrap-Up

Online banking is fast-growing, and there are no signs of the trend slowing down anytime soon because the world is now adopting digital-first products and services almost unilaterally.

Therefore, if you want to experience faster banking services and enjoy a range of benefits which will improve the health of your personal finances – then you really should join online banking.

It is essential to get an account in one of the digital banks if you want to keep up with the pace, make banking work better and more conveniently for you.

Whether you already have an account with a traditional bank or not, a modern Alternative Bank account is a great way to bank better and improve your financial health.

Want to read more about Neo Banks and Challenger Banks?

If you’re based in the UK, we have curated a list of the Top 5 UK Challenger Banks for your money in 2023

We’ve also written up a companion article which looks further at the benefits of opening a Challenger Bank. You can check out that article here: Uncovered – Why open a Challenger Bank account in 2023

Beyond banking and mobile banking apps, if you like the sound of some of the new opportunities being offered by trading apps such as eToro and Plus500, then we’d recommend that you check out our posts on Money and Wealth.